2017 Highlights

We are a market leading, vertically integrated UK manufacturer, distributor and recycler of innovative window, door and roofline PVC building products.

Download pdf (0.2mb)in 2017 1,496

At a Glance

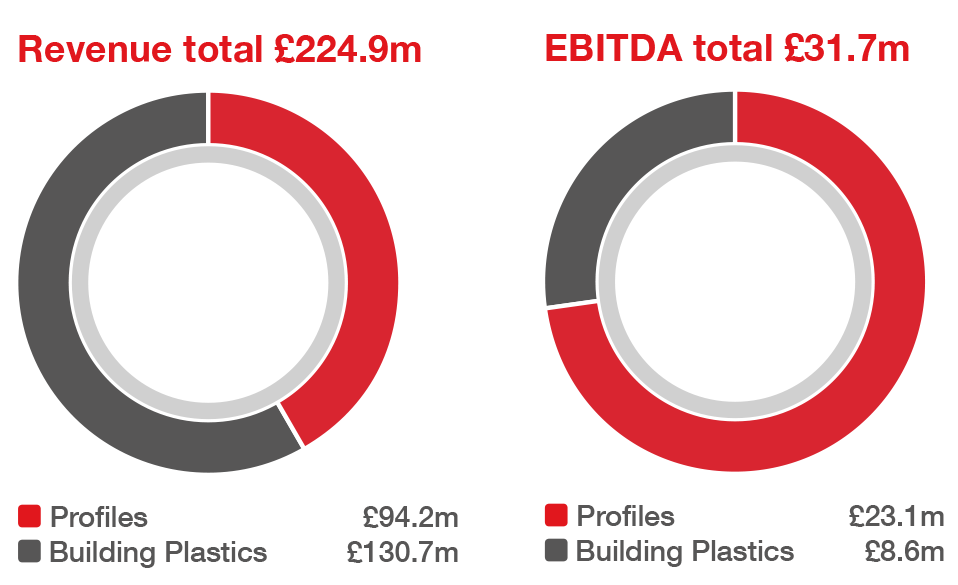

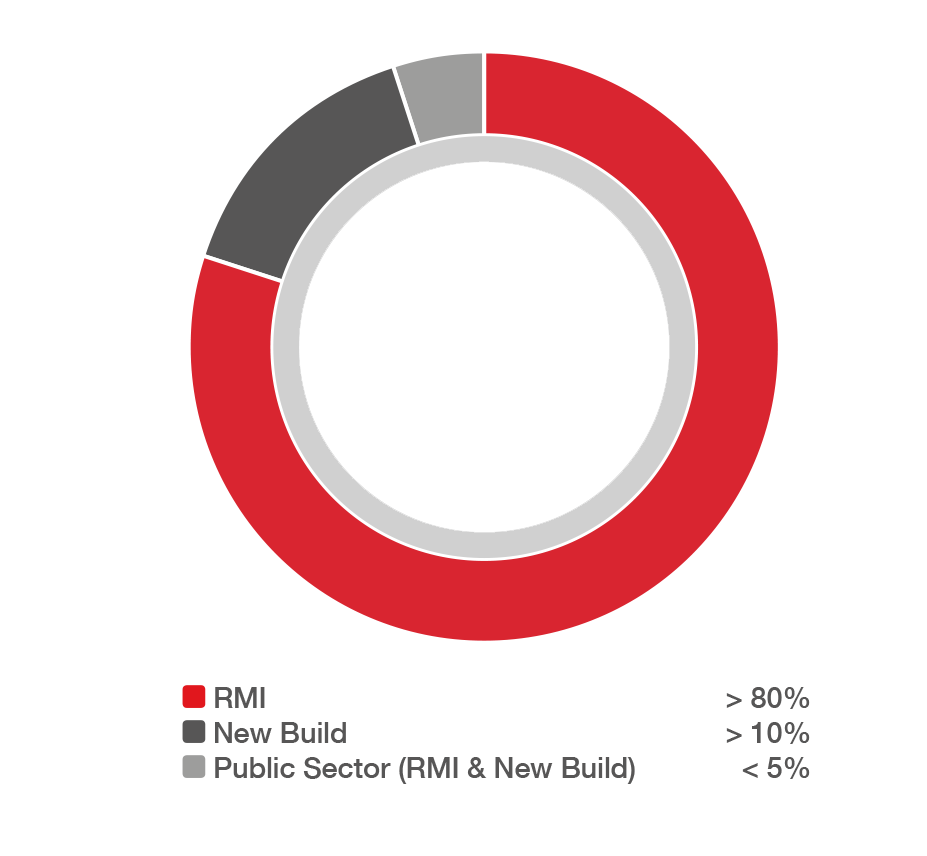

We operate our business through two divisions that reflect the principal routes to market for our products: Profiles and Building Plastics.

Download pdf (0.3mb)Chairman’s Statement and Investment Case

Against a more challenging economic backdrop, we have reported robust financial results and delivered another consistent operational performance.

Download pdf (0.2mb) I am pleased to report we have made good progress with our strategic priorities in 2017 and that the business continues to outperform its markets.”

Bob Lawson

Chairman

I am pleased to report we have made good progress with our strategic priorities in 2017 and that the business continues to outperform its markets.”

Bob Lawson

Chairman

On average, markets for the product groups specific to Eurocell are also currently expected to be flat over the next two years.

Eurocell revenue by market (%)

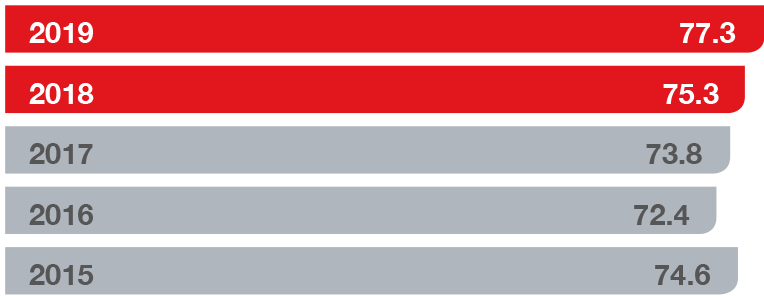

Roofline (Tonnes 000s)

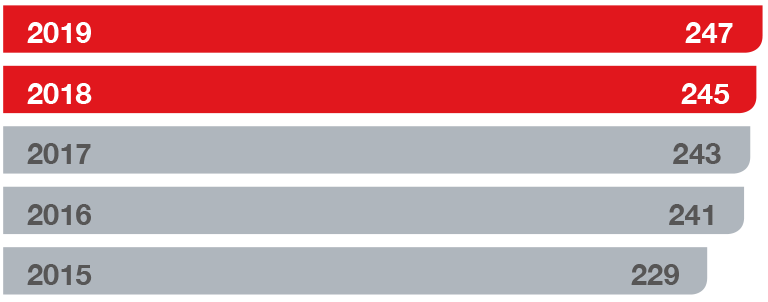

Window Profile (Tonnes 000s)

Source: D&G Consulting

Source: D&G Consulting

Market Overview

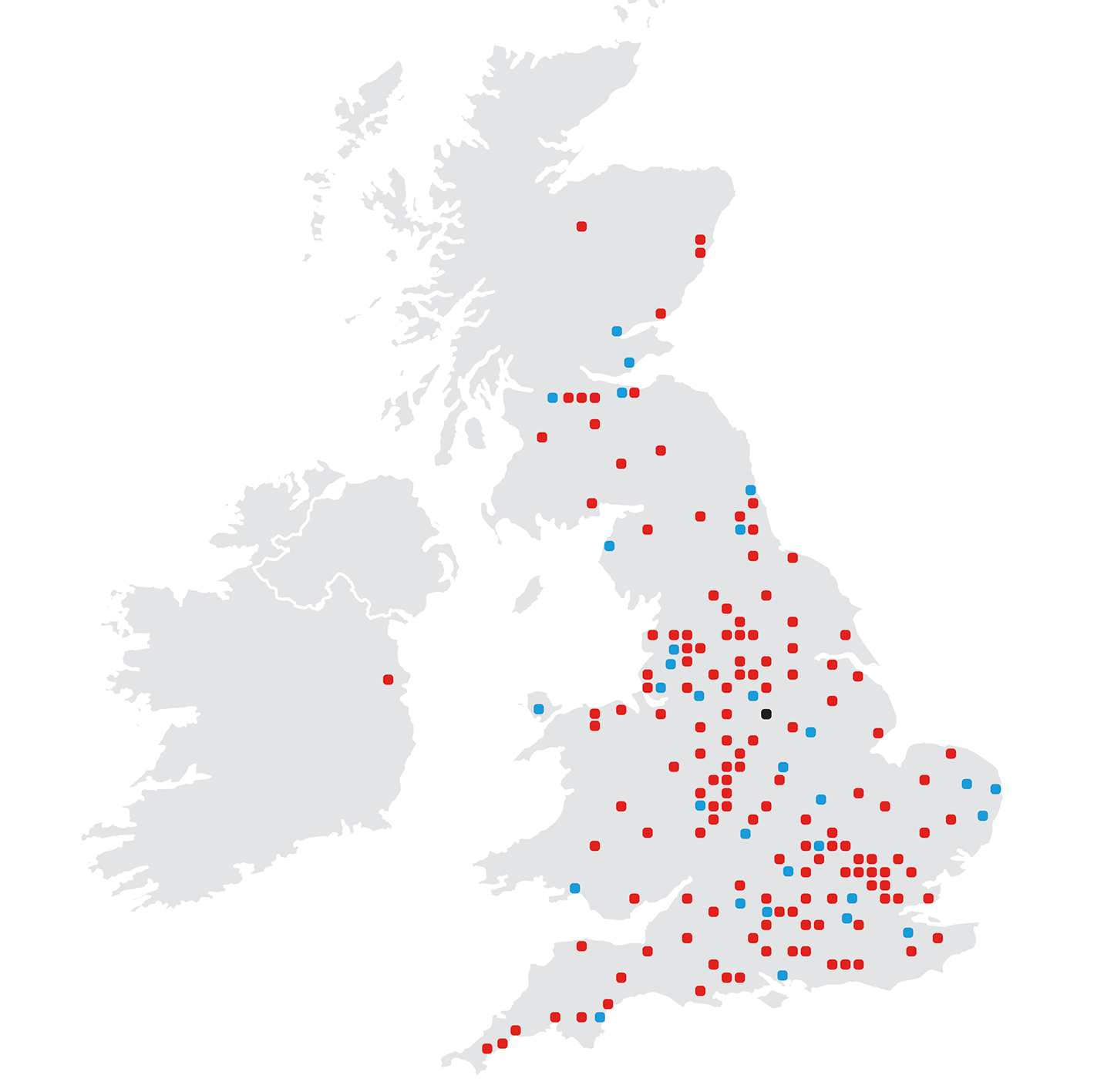

The level of UK economic activity, in particular the state of the repair, maintenance and improvement (‘RMI’) and new build housing markets, are important drivers of our performance.

Download pdf (0.2mb)WE MANUFACTURE

We are a leading manufacturer of rigid and foam PVC profiles, composite and PVC entrance doors for the window and building home improvement sectors. Our manufacturing process use raw materials including PVC resin and our own produced recycled material.

WE DISTRIBUTE

The Profiles division supplies our manufactured profile to a network of fabricators, who in turn supply end products to installers, retail outlets and house builders.

The Building Plastics division sells, through its network of branches, our manufactured foam products and entrance doors, along with a range of Third-party related products, as well as windows fabricated by third parties using products manufactured by the Profiles division. Customers are mainly installers, small builders, roofing contractors and independent stockists.

WE RECYCLE

We recycle both customer factory offcuts (‘post-industrial’ waste) and old windows that have been replaced with new (‘post-consumer’ waste). The recycled material is used to generate brand new extruded plastic products.

Vertically integrated model

The coordination of our procurement, manufacturing and distribution processes enables us to capture margin throughout all stages of our value chain.

Our recycling activities help lower material costs and improve production stability.

Scale

We operate well-invested and modern extrusion facilities, with spare manufacturing capacity that can be exploited with little incremental cost.

We are the UK’s largest window recycling operator.

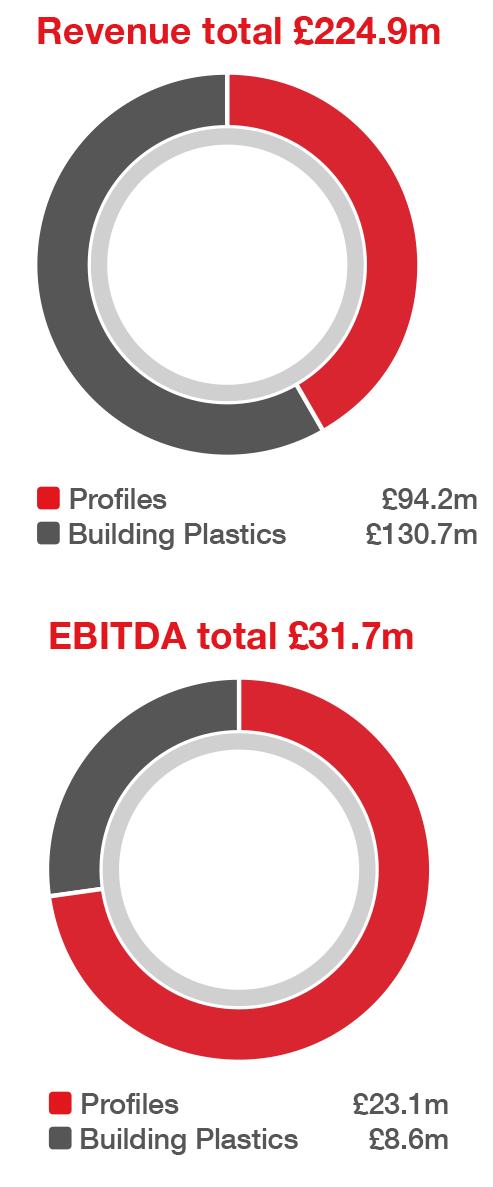

Our extensive branch network is a driver of sales growth and market share. It also helps improve manufacturing efficiency, with pull-through demand driving higher factory utilisation.

Innovative products

We are committed to a strategy of continually developing new and existing products.

We support the use of Building Information Modelling (BIM) software, giving architects and contractors access to a library of Eurocell products, making it easier to specify them.

Brand

We have a strong brand image and our marketing activities seek to maximise our brand awareness.

People and culture

Our experienced management team have a proven track record of achieving profitable growth.

Our corporate culture is one of openness, trust, encouragement and clarity of purpose. We train and empower our people to help our customers grow their businesses.

Local footprint

Our branches are conveniently located and have readily available inventory, thereby providing excellent service to local customers and national groups alike.

We also strive to help our customers through the provision of technical, business development and marketing support services.

Sales growth

Our initiatives to support sales and deliver high levels of customer service differentiate Eurocell from our competitors. We expect this to drive good sales growth.

Solid Profitability

Utilisation of our spare manufacturing capacity can drive profit growth.

Expanding the branch network, whilst dilutive until new branches become established, should deliver strong medium-term returns.

Increased use of recycled materials can help mitigate raw material pricing pressure.

Good cash generation

Our operating cash flow conversion is good, particularly in the Building Plastics division, where a high proportion of customers pay at point of sale or shortly thereafter.

Good return on sales

Our strong brand, well-invested facilities and capital-light branch expansion programme ensure a good return on sales.

SHAREHOLDERS

Our overall strategic objective is to deliver sustainable growth in Shareholder value.

FABRICATORS

Through high-quality products and a strong focus on customer service, we have developed a very loyal customer base.

SMALL BUILDERS AND INSTALLERS

The independent sole traders that visit our branches benefit from the one-stop shop offering we provide.

HOME BUILDERS

Home builders appreciate the quality of our products and benefit from Eurocell coordinating our fabricators' offering to meet their requirements.

INSTALLERS

We aim to make our products as easy as possible to work with, which is very attractive to our direct or indirect installer base.

EMPLOYEES

We work hard to train and develop our people, and provide rewards commensurate with our goal to be an employer of choice.

Strategic Priorities

Our Strategy

Our overall objective is to deliver sustainable growth in shareholder value by increasing sales and profits at above market level growth rates through leadership in products, operations, sales, marketing and distribution.

Download pdf (0.2mb)Download Centre

Overview

Strategic report

- Chairman's Statement

- Market Overview

- Chief Executive's Review

- Our Business Model

- Business Model in Action - Manufacturer

- Business Model in Action - Distributor

- Business Model in Action - Recycler

- Our Strategy

- Divisional Reviews

- Group Financial Review

- Corporate Social Responsibility

- Principal Risks and Uncertainties

- Viability Statement

Corporate governance

Financial statements

- Independent Auditor's Report (Group and Company)

- Consolidated Statement of Comprehensive Income

- Consolidated Statement of Financial Position

- Consolidated Cash Flow Statement

- Consolidated Statement of Changes in Equity

- Notes to the Financial Statements

- Company Statement of Financial Position

- Company Statement of Changes in Equity

- Notes to the Company Financial Statements

- Company Information