The Board is committed to the highest standards of corporate governance and to maintaining a sound framework for the control and management of the Group.

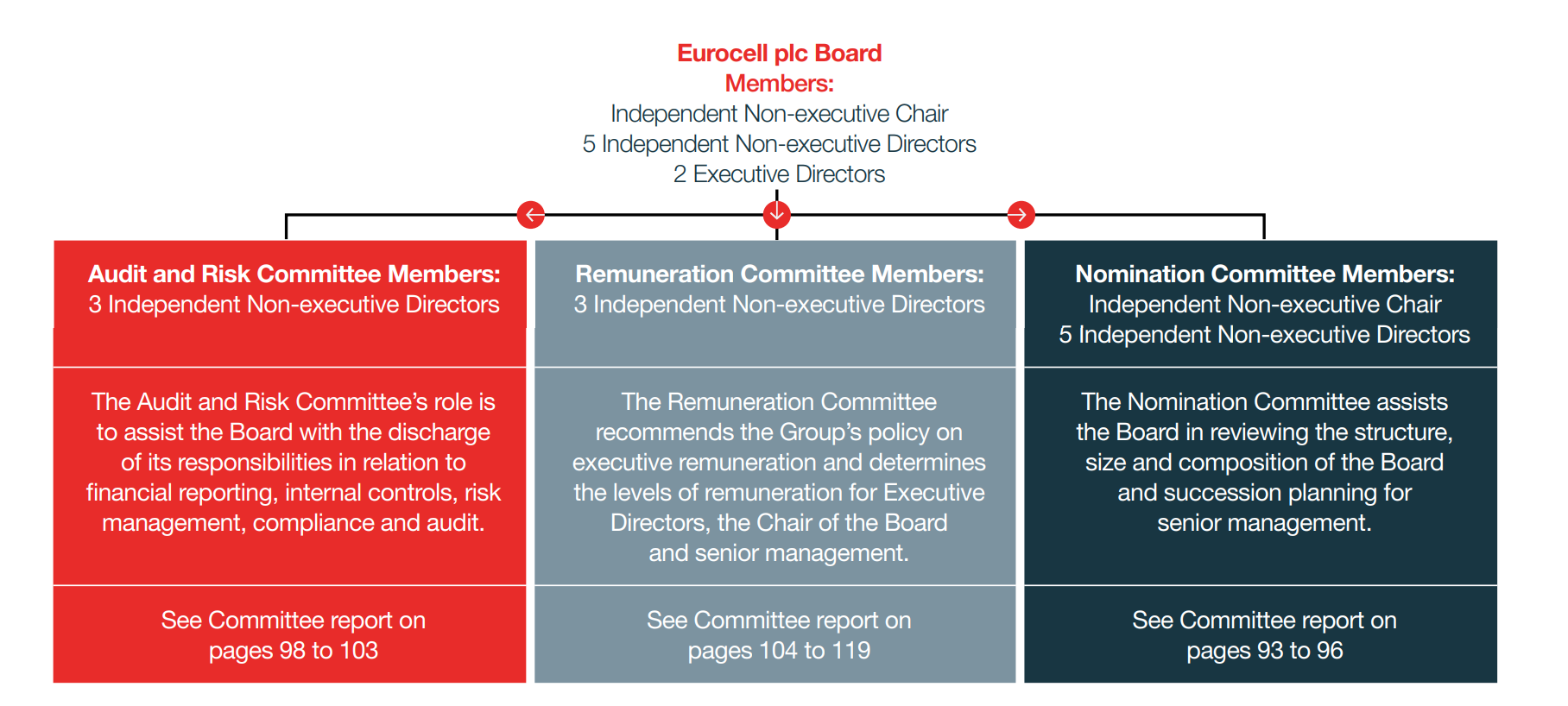

There are written terms of reference for each of these Committees which are available on the Group’s corporate website, www.investors.eurocell.co.uk. Separate reports for each Committee are included in this Annual Report from pages 93 to 119.

Day-to-day management and the implementation of strategies agreed by the Board are delegated to the Executive Directors. Key to this delegation is the Executive Committee, which meets each month.

The Board meets regularly to discuss key business issues and prescribe actions as appropriate. The Group’s reporting structure below Board level is designed so that all decisions are made by those most qualified to do so in a timely manner. Day-to-day management and the implementation of strategies agreed by the Board are delegated to the Executive Directors. Key to this delegation is the Executive Committee, which meets each month.

This structure enables the Board to make informed decisions on a range of key issues including strategy and risk management.

All the Directors have the right to have their opposition to, or concerns over, the operations of the Board and/or the management of the Company, noted in the minutes.

During the year, no such opposition or concerns were noted.

The Chair and the Non-executive Directors met during the year without the Executive Directors present.

ROLE OF THE CHAIRplus

The Board has concluded that the Chair has met the independence criteria of the Code on appointment.

There is a clear division of responsibilities between the Chair and the Chief Executive Officer.

The Chair is responsible for ensuring that the Board functions effectively. He sets the agenda for Board meetings and ensures that adequate time is devoted to discussion of all agenda items, particularly strategic issues, facilitating the effective contribution of all Directors and ensuring that the Board as a whole is involved in the decision-making process.

ROLE OF THE CHIEF EXECUTIVE OFFICERplus

The Chief Executive Officer has principal responsibility for all operational activities and the day-to-day management of the business, in accordance with the strategies and policies approved by the Board. The Chief Executive Officer also has responsibility for communicating to the Group’s employees the expectations of the Board in relation to culture, values and behaviours.

ROLE OF THE SENIOR INDEPENDENT DIRECTOR AND NON-EXECUTIVE DIRECTORSplus

The Senior Independent Director has an important role on the Board, providing a sounding board for the Chair, leading on corporate governance issues and serving as an intermediary for the other Directors. He is available to shareholders if they have concerns which contact through the normal channels of the Chair, Chief Executive Officer or other Executive Directors has failed to resolve, or for which such contact is not appropriate.

Frank Nelson has served as Senior Independent Non-executive Director throughout the year.

All Non-executive Directors are required to allocate sufficient time to the Company to discharge their responsibilities effectively. The Non executive Directors act in a way they consider will promote the long-term sustainable success of the Group for the benefit of, and with regard to the interests of, its stakeholders.

BOARD COMPOSITION, COMMITMENT AND ELECTION OF DIRECTORSplus

The Nomination Committee leads the process for Board appointments and makes recommendations to the Board. Prior to appointment, Board members, in particular the Chair and the Non-executive Directors, disclose their other commitments and agree to allocate sufficient time to the Company to discharge their duties effectively and ensure that these other commitments do not affect their contribution.

The Executive Directors may accept an outside appointment provided that such appointment does not in any way prejudice their ability to perform their duties as Executive Directors of the Company. Mark Kelly and Michael Scott do not currently hold any outside appointments.

The Non-executive Directors’ appointment letters anticipate a minimum time commitment of 20 days per annum, recognising that there is always the possibility of an additional time commitment and ad hoc matters arising from time to time, particularly when the Company is undergoing a period of increased activity. The average time commitment inevitably increases where a Non-executive Director assumes additional responsibilities such as being appointed to a Board Committee.

All new Non-executive Directors undergo an induction programme and as such spend considerably more than the minimum commitment during the course of a year. All Non-executive Directors are required to inform the Chair before accepting another position in order to ensure the Director has sufficient time to fulfil their duties.

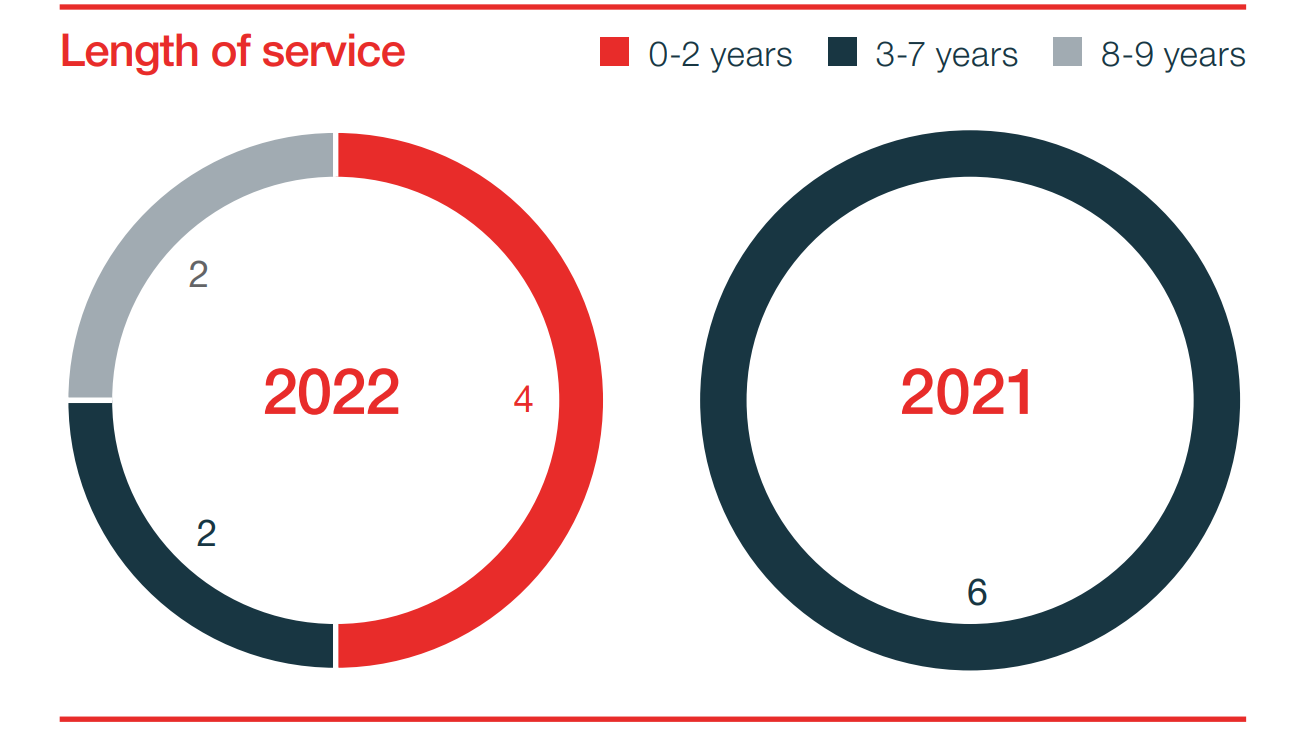

The length of service on the Board is set out in the chart below:

The Company’s Articles of Association contain powers of removal, appointment, election and re-election of Directors and provide that all of the Directors must retire and may offer themselves for re-election at each Annual General Meeting (‘AGM’).

At the upcoming AGM, all the current Directors intend to offer themselves for election/re-election, with the exception of Mark Kelly and Martyn Coffey both of whom have decided to step-down after seven and eight years of service respectively. Following the conclusion of the Board evaluation process, the Board considers all the Directors to be effective, committed to their roles and to have sufficient time available to perform their duties.

The Board has a process in place to assess the current and future skills and experience needed by the Non-executive Directors against a matrix of requirements, through which it has determined that the Non-executive Directors are independent and that the Board, as a whole, has appropriate and complementary skills and experience.

BOARD EVALUATION AND EFFECTIVENESSplus

In accordance with the Code, a formal evaluation of the performance of the Board, its Committees, the Chair and individual Directors was conducted during the year, with the results presented and discussed at the December 2022 Board meeting.

Given the number of relatively new appointments to the Board during 2022, this evaluation was performed internally by the Chair of the Board.

Interviews were conducted with each Board member and the Group Company Secretary, all of whom fully engaged with the process and provided their qualitative feedback. The anonymity of respondents was ensured to promote an open and frank exchange of views.

The interviews identified a number of perceived areas of strength and some areas for enhancement. It was also recognised that a combination of the continuity provided by longer-standing Board members, together with the fresh thinking from newer members, were together working well to support the Board through its transition.

An overview of the conclusions includes:

- The Board refresh had promoted a positive and healthy reflection on previously held views and assumptions.

- The new Board was gaining familiarity of each other, the business, its people and its challenges.

- More strategic, and less operational, updates at meetings would continue to further improve the quality of the Board’s debate.

- ESG, culture and people engagement would be given increased board focus in 2023, including the creation of a new ‘Social Values and ESG’ Board Committee.

- A clear plan regarding Board succession was in place, including the potential future recruitment of an additional Non-executive Director in due course.

- Greater Board visibility and interaction with the leadership team was to be developed.

Overall, the results of the interviews indicated that the Board members are satisfied that the Board is operating at an acceptable level in a constructive and collaborative way.

The Board believes that the evaluation process described above was appropriate, given the number of relatively new appointments to the Board, but will be reviewed for future years. Taking all of the above into account, the Board is satisfied that the current composition of the Board, and its Committees, provides an appropriate balance of skills, experience, independence and knowledge to allow the Board and its Committees to discharge their duties and responsibilities effectively and in line with the Code.

Conflicts of interestplus

The duties to avoid potential conflicts and to disclose such situations for authorisation by the Board are the personal responsibility of each Director. All Directors are required to ensure that they keep these duties under review and to inform the Group Company Secretary of any change in their respective positions.

The Company’s conflict of interest procedures are reflected in its Articles of Association (‘Articles’). In line with the Companies Act 2006, the Articles allow the Directors to authorise conflicts and potential conflicts of interest, where appropriate. The decision to authorise a conflict can only be made by non-conflicted Directors.

The Board, and its Committees, considers conflicts or potential conflicts at each meeting and, where such instances are identified, takes appropriate action, usually by excluding the conflicted party from any related discussions/decisions.

The Articles require the Company to indemnify its officers, including officers of wholly-owned subsidiaries, against liabilities arising from the conduct of the Group’s business, to the extent permitted by law.

For a number of years, the Group has purchased Directors’ and Officers’ liability insurance and this is anticipated to continue.

BOARD MEETINGS AND ATTENDANCEplus

There were seven full Board meetings scheduled during 2022, three meetings of the Audit and Risk Committee, three meetings of the Remuneration Committee and five meetings of the Nomination Committee. All of these meetings were held in-person, with the exception of one Board meeting and one Audit and Risk Committee meeting, which were held virtually to accommodate pre-existing commitments and therefore ensure full attendance.

In addition, two virtual Board update meetings were held during 2022, following their successful introduction in 2020, in order to keep the Board fully updated on financial and operational matters. There was full attendance for both of these update meetings which help maintain a high level of Board awareness and support good governance.

The Chair of the Board, Chief Executive Officer and Chief Financial Officer are usually invited to attend Audit and Risk Committee meetings, although the Audit and Risk Committee also meets with the external auditor without any Executive Directors being present.

The Chief Executive Officer and Chief Financial Officer are invited to attend Remuneration Committee meetings when appropriate, but are never involved in discussions and decisions regarding their own remuneration.

The Group Company Secretary is also Secretary to the Audit and Risk, Remuneration and Nomination Committees, and attends meetings for this purpose.

| Board | Number of meetings attended | Audit and Risk Committee | Remuneration Committee | Nomination Committee |

|---|---|---|---|---|

| Derek Mapp (appointed 16 May 2022) | 5/5 | - | 1/1 | 3/3 |

| Bob Lawson (retired 30 June 2022) | 2/2 | - | 1/1 | 1/1 |

| Frank Nelson | 7/7 | 3/3 | 3/3 | 5/5 |

| Martyn Coffey | 6/7 | 2/3 | 3/3 | 5/5 |

| Mark Kelly | 7/7 | - | - | 4/4 |

| Michael Scott | 7/7 | - | - | - |

| Sucheta Govil (stepped down 31 July 2022) | 2/3 | 1/1 | 1/1 | 1/3 |

| Kate Allum (appointed 1 July 2022) | 4/4 | 2/2 | 2/2 | 2/2 |

| Alison Littley (appointed 1 July 2022) | 4/4 | 1/2 | 1/1 | 2/2 |

| Iraj Amiri (appointed 7 November 2022) | 2/2 | 1/1 | -/- | -/- |

All absences were due to a clash with a pre-existing engagement.

Board packs are distributed in the week prior to each meeting to provide sufficient time for Directors to review their papers in advance. If Directors are unable to attend a Board meeting for any reason, they nonetheless receive the relevant papers and are consulted prior to the meeting and their views are made known to the other Directors.

THE GROUP COMPANY SECRETARYplus

All the Directors have access to the advice and services of the Group Company Secretary. The Group Company Secretary has responsibility for ensuring that all Board procedures are followed and for advising the Board, through the Chair, on all governance matters. The Group Company Secretary provides updates to the Board on regulatory and corporate governance issues, new legislation, and Directors’ duties and obligations. The appointment and removal of the Group Company Secretary is one of the matters reserved for the Board.

Paul Walker has served as Group Company Secretary throughout the year.

Whenever necessary, Directors may take independent professional advice at the Company’s expense. Board Committees are provided with sufficient resources to undertake their duties, including the option to appoint external advisers when they deem it appropriate.

BOARD INDUCTION, DEVELOPMENT AND SUPPORTplus

Following appointment, a new Director undergoes an induction programme, which includes a teach-in from Executive Committee members on key aspects of the business, including the background to our industry and markets, as well as the Company’s strategy, commercial approach, manufacturing and logistics operations, administrative functions and culture.

Summary of induction programme:

| Understand the business |

|

| Meet our colleagues |

|

Individual development and training needs are identified through the Board evaluation process and through individual reviews between the Directors and the Chair.

RISK MANAGEMENT AND INTERNAL CONTROLplus

The Board acknowledges its responsibility for determining the nature and extent of the significant risks it is willing to take in achieving its strategic objectives, and for the Group’s system of internal control.

The Board has carried out a review of the effectiveness of the Group’s risk management and internal control systems, including financial, operational and compliance controls, for the period covered by this Annual Report.

The Strategic Report comments in detail on the nature of the principal risks and uncertainties facing the Group; in particular those that would threaten our business model, future performance, solvency or liquidity and the measures in place to mitigate them. In conducting its review, the Board has included a robust assessment of these risks and the effectiveness of mitigating controls.

The Audit and Risk Committee Report describes the internal control system and how it is managed and monitored.

The Board confirms that no significant failings or weaknesses were identified in relation to the review. The Board also acknowledges that such systems are designed to manage, rather than eliminate, the risk of failure to achieve business objectives and can only provide reasonable and not absolute assurance against material misstatement or loss.

The cyber incident noted above was not the result of a breakdown in internal controls. Our investments over the last several years in enhanced cyber security played a major role in identifying the incident, enabling core systems to be restored quickly and mitigating the overall impact on the Group. Following the incident, we have also implemented further resilience and security in this area.

STAKEHOLDER ENGAGEMENTplus

Engagement with our shareholders and wider stakeholder groups plays a vital role across the Group, including at Board level. One of the primary areas of focus for the Board at any time is the impact its decisions or actions may have on key stakeholder groups represented within the Board’s duty under s172 of the Companies Act 2006.

The Board is mindful of the levels of engagement with key stakeholder groups and how their respective views may be incorporated into relevant decision-making. Board discussions therefore seek to appropriately consider the impact of its decisions and views of key stakeholder groups thereon, whilst always ensuring the need to promote the success of the Company for the benefit of its members as a whole. In doing so s172 requires the Directors to have regard (amongst other matters) to:

(a) the likely consequences of any decision in the long term;

(b) the interests of the Company’s employees;

(c) the need to foster the Company’s business relationships with suppliers, customers and others;

(d) the impact of the Company’s operations on the community and the environment;

(e) the desirability of the Company maintaining a reputation for high standards of business conduct; and

(f) the need to act fairly as between members of the Company.

The Board considers information from across the organisation to help understand the impact of its operations and decisions, and the interests and views of our key stakeholders. This includes reviews of strategy, financial and operational performance, as well as information covering areas such as key risks, and legal and regulatory compliance.

This information is provided to the Board, and its Committees, through reports sent in advance of each meeting, and through in-person presentations, where appropriate. As a result of these activities, the Board has developed a good understanding of the interests and views of all stakeholders, and other relevant factors, which enables the Directors to comply with the requirements of section 172 of the Companies Act 2006.

The table overleaf sets out the Board’s approach to stakeholder engagement, why stakeholders matter and some key decisions made during 2022. The Board will sometimes engage directly with certain stakeholders on certain issues, but the size and distribution of our stakeholders and of the Eurocell Group dictate that stakeholder engagement often takes place at an operational level.

To give greater understanding to this, we have provided clear cross-referencing to where more detailed information can be found in this Annual Report and Financial Statements.

| Why they matter |

Shareholders – The Board recognises the importance of engaging with all shareholders and prioritises effective dialogue to ensure that we capture and embrace feedback relating to areas of interest and of concern, and to ensure that our obligations are met. Employees – The Board understands that our colleagues underpin the performance and success of our business and, therefore, the importance of providing a safe working environment that promotes inclusion and diversity, as well as ensuring they have the opportunity to realise their potential and progress in their careers. Customers – The Board recognises the dependence of our growth plans on building strong and lasting relationships with our customers. Inter alia, this requires that we continuously improve product ranges, quality, availability and service to become the supplier of choice. Suppliers – The Board appreciates that to operate effectively we must ensure secure supplies of good quality sustainable materials at a fair price from suppliers with high ethical standards, and monitor supplier performance against appropriate metrics. Communities and environment – The Board understands the role all organisations have to play in protecting the environment and in mitigating the impact of climate change. The Board also recognises the need to support the local communities in which our larger facilities are located. Government and regulatory/ industry bodies – The Board recognises the critical importance of ensuring the highest standards of corporate governance, including compliance with the rules for listed companies and other relevant regulations (e.g. health & safety, taxation), which together give us our licence to operate. |

| How we engage |

Shareholders – The Group runs a comprehensive investor relations programme that results in regular dialogue with the investment community. This includes formal presentations made to institutional shareholders and analysts, following the announcement of the Group’s half-year and full-year results, covering a range of key topics affecting the Group’s strategy, financial and operating performance. Ad hoc meetings are also held following trading updates and otherwise throughout the year. The Chair, the Senior Independent Director and the other Directors are available to engage in dialogue with major shareholders as appropriate. Shareholders have the opportunity to meet members of the Board and the senior management team at the Annual General Meeting and to ask any questions they may have. Employees – The Group conducts periodic staff surveys. In 2022 this included the annual ‘Pulse’ survey, combined with subsequent listening groups, to source the views of colleagues directly on several important topics and develop appropriate action plans. All results are analysed, shared with colleagues and used to drive appropriate change and improvement. Management regularly ‘walk the floor’ to understand first-hand the experiences of our colleagues and also undertake visits to operating sites and branches to ensure all parts of the Group are understood and taken into account in formulating action plans. Regular team-briefings on operational and financial performance, coupled with the publishing of internal bulletins (‘In the Know’), help to keep our colleagues well informed. All whistleblowing reports and grievances are investigated and appropriate changes implemented to help prevent reoccurrence. Customers – Regular contact takes place between senior management and key customers, with our sales teams ensuring we engage properly across the full range of customers. Customer reviews discuss our operational performance, including service levels and other relevant matters. We perform customer insight surveys on a regular basis to assess satisfaction and ‘Net Promoter Scores’. In addition, quarterly forums are held with customer groups to discuss product design and innovation. Regular monitoring of social media platforms for relevant comments/issues, coupled with Trustpilot customer reviews/ ratings and direct comments received from customers visiting our branches, provide valuable customer insight. Suppliers – Our objective is to build and maintain strong and lasting working relationships with our supplier base. Regular review meetings are held between senior management and key suppliers to discuss relevant topics, such as pricing, supply continuity and service levels. Formal tender processes are undertaken for large and / or high value supplies, which helps develop relationships and creates a better understanding for all parties of the key issues involved. Communities and environment – We believe sustainability sits right at the heart of our business. We are the leading UK-based recycler of PVC windows, through our two recycling sites in Selby and Ilkeston, which drive a very large carbon saving compared to the use of virgin materials. Our major sites engage with and support their local communities on an ongoing basis. We seek to recruit locally, retain a skilled local workforce, build relationships with local community organisations and support charitable initiatives where possible. Government and regulatory/ industry bodies – The Company applies the principles and provisions of the UK Corporate Governance Code and operates structures and policies to ensure ongoing compliance. We also operate clear and effective policies to help prevent wrongdoing, including whistleblowing, bribery and corruption, fraud, financial crime and modern slavery, with training provided where appropriate. Regular meetings are held with tax advisers to discuss tax compliance, HMRC correspondence and other relevant issues pertinent to the Group’s finances and tax position. The Company is a member of both the Windows and Recycling groups of the British Plastics Federation and the British Fenestration Rating Council, which provide a forum to understand changes in relevant legislation and building standards. |

| How the board complements engagement efforts |

Shareholders – During 2022, the Chair met with some of our largest shareholders without the Executive Directors being present. The Board also received regular updates on shareholder engagement and investor feedback, analyst reports and share price developments from the Chief Financial Officer. Employees – During 2022, the Board received updates on the progress of our colleague engagement initiatives and, in particular, considered the results of the staff surveys and the proposed action plan to address matters arising. This included the Board being instrumental in driving proposed improvements to the employee value proposition, including staff welfare and facilities. Board members were also able to share their own experiences and ideas to address the retention and recruitment challenges that continued through the year. The Chief Executive Officer provided regular updates to the Board on health and safety matters and the steps taken to ensure appropriate safety and wellbeing arrangements were in place. Customers – Throughout 2022, the Board received regular updates on our performance against customer service-related KPIs, compared to historical and industry/sector benchmarks. Suppliers – The Board has significant experience in supply chain management. During 2022, raw material availability and pricing have been discussed at all Board meetings and updates. Board members have shared their ideas and experiences on supplier relationships and engagement, in the light of current supply chain risks and challenges. Communities and environment – The Board is actively engaged with the development and implementation of the Group’s ESG strategy. The Board receives regular updates on sustainability issues, including the performance of the two recycling sites. Government and regulatory/ industry bodies – The Audit and Risk Committee receives regular reports on governance, regulatory and compliance matters from management and from external and internal auditors. The internal audit programme is designed to provide assurance in this area. In addition, the Board receives updates on matters such as developments in building regulations and our associated new product development initiatives.

|

| How their interests were considered during 2022 |

Shareholders – Investor relations is covered at all Board meetings and updates. The Board reviewed the strategy of the business and identified where emphasis should be placed in the medium-term, including capitalising on opportunities for market share growth in Profiles, driving value from the existing branch network and improving the employee value proposition. The Board also approved defensive measures in Q4, including a cost saving programme and the sale of Security Hardware. These actions leave the business better placed for the future. Employees – The Board approved management’s proposals to improve staff welfare facilities and also introduce:

The Board also approved capital expenditure for a new HR information system, which is expected to significantly improve the employee experience at Eurocell when launched in 2023. These actions support our objective to become an employer of choice in the regions we operate. Customers – The Board approved capital expenditure to improve operational efficiency and ultimately customer service, including new carousel warehouse racking. Approved capital expenditure also included a new website and e-commerce platform, which will be launched in 2023, with the aim of significantly improving the customer journey. The Board also approved a medium term contract with a new supplier of rainwater products, which is expected to significantly improve product quality and availability in the branches. Suppliers – The Board continued to work with and advise management on their approach, including:

Communities and environment – The Board approved the formation of a ‘Social values and ESG’ committee. The purpose of the committee is to provide oversight of the Group’s ESG programme, including:

Government and regulatory/ industry bodies – The Board supported management’s ongoing initiative to engage and collaborate with industry bodies, house builders, energy consultants and glass/hardware manufacturers to develop new products to meet the Government’s ‘Future Homes Standard’ for the new build sector. |

Cultureplus

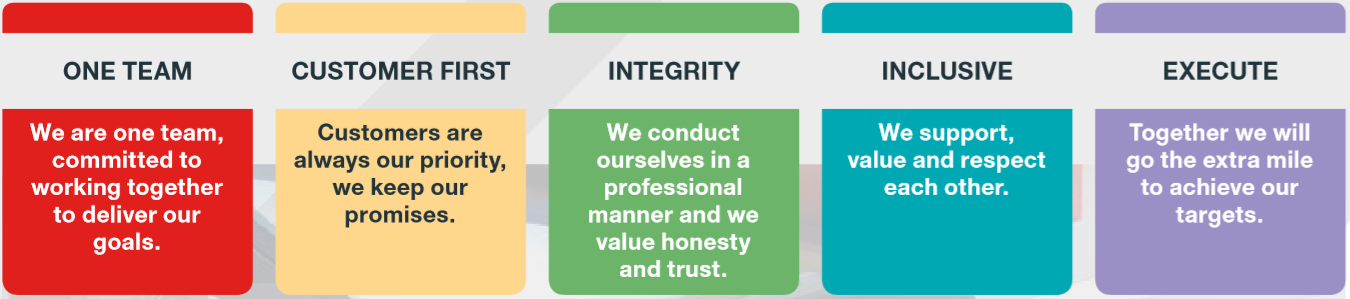

The Group’s culture is based on the following Vision and Values which were formally introduced in 2018:

Our Vision:

One team, customer centric, driving world class solutions everywhere we operate.

Our Values:

ENGAGEMENT WITH THE WORKFORCEplus

We recognise that our colleagues underpin the performance and success of our business and active engagement has never been more important in the current social, economic and political environment.

The Group organises a number of colleague engagement initiatives to complement the existing team briefings, continuous improvement workshops, newsletters and health and safety forums currently in place, including:

- colleague focus groups with the designated Non-executive Director, Alison Littley, to ensure workforce views are heard by the Board;

- departmental ‘listening groups’ to allow colleagues to give direct feedback from which appropriate action plans can be formulated;

- group-wide ‘Pulse’ and ‘Safety, Health, Environment and Quality’ staff surveys, to provide invaluable insight into how our colleagues feel;

- review of retention and recruitment challenges, to identify areas for improvement and ensure we remain competitive in the labour market;

- enhancement of the induction process for new colleagues, to help address short-term staff turnover;

- more flexible approaches to working, including hybrid working where appropriate;

- enhancement of colleague facilities and rest-room arrangements, as part of overall staff welfare improvements; and

- continued opportunity for all colleagues to become shareholders via the Save As You Earn scheme, to share in the Group’s success.

In addition, the Board assesses and monitors culture through:

- reviews of staff survey results and response rates;

- reviews of staff turnover rates;

- reviews of health and safety data, including near misses;

- reviews of employee whistleblowing cases;

- interaction with senior management and workforce; and

- observation of attitudes towards regulators such as HMRC and HSE, as well as internal and external auditors.

The Board is satisfied the above practices and behaviours throughout the Group are developing well to support improved employee engagement. In addition, as set out in ‘Valuing our people’, we have a number of in-progress and planned initiatives to improve our employee value proposition and retention rates, and drive down labour turnover.

STATEMENT OF COMPLIANCE WITH THE CODEplus

This Corporate Governance Statement, together with the Nomination Committee Report, the Audit and Risk Committee Report and the Remuneration Committee Report, provide a description of how the principles and provisions of the Code have been applied during 2022.

It is the Board’s view that, during 2022, Eurocell plc was in compliance with the relevant provisions set out in the Code in all material respects except for Provision 38.

Provision 38 provides that Executive Director pension contribution rates (or payments in lieu) should be in line with those available to the workforce. Our incumbent Executive Directors’ pension contribution rates, while in line with the policy for existing Executive Directors, did not match the wider workforce during the year, although they have been subsequently adjusted from 1 January 2023 onwards – see below for further details.

During the year, the changes proposed to the Directors’ Remuneration Policy, resulted in the pension contributions for the incumbent Executive Directors being reduced to 10% of salary from April 2022 onwards, in order to be aligned with those with the highest rate below the Board level. From 1 January 2023, in line with the Investment Association’s guidance, the contributions were further reduced for Michael Scott to 5% to be aligned with those available to the workforce. In the light of Mark Kelly’s upcoming retirement, his pension contributions have not been reduced.

This statement complies with sub-sections 2.1, 2.2(1), 2.3(1), 2.5, 2.7 and 2.10 of Rule 7 of the Disclosure Rules and Transparency Rules of the Financial Conduct Authority.

ANNUAL GENERAL MEETINGplus

Our AGM will be held at our Head Office on 11 May 2023.

The notice of our AGM, together with the Directors’ voting recommendations on the resolutions to be proposed, is included on a separate circular to shareholders and will be dispatched at least 20 working days before the meeting. The notice will be available to view at investors.eurocell.co.uk.

All Directors intend to attend the AGM, including the Chairs of the Audit and Risk, Remuneration and Nomination Committees, who are available to answer questions. The Board welcomes questions from shareholders who have an opportunity to raise issues informally or formally before or during the meeting.

For each proposed resolution, the proxy appointment forms provide shareholders with the option to direct their proxy vote either for or against the resolution or to withhold their vote. The proxy form and any announcement of the results of a vote make it clear that a ‘vote withheld’ is not a vote in law and will not be counted in the calculation of the proportion of the votes for and against the resolution.

All valid proxy appointments are properly recorded and counted by Equiniti, the Company Registrars. Information on the number of shares represented by proxy, the proxy votes for and against each resolution, and the number of shares in respect of which the vote was withheld for each resolution, together with the proxy voting result, are given at the AGM. The total votes cast, including those at the AGM are published on our website (investors.eurocell.co.uk) immediately after the meeting.

- Next Committees